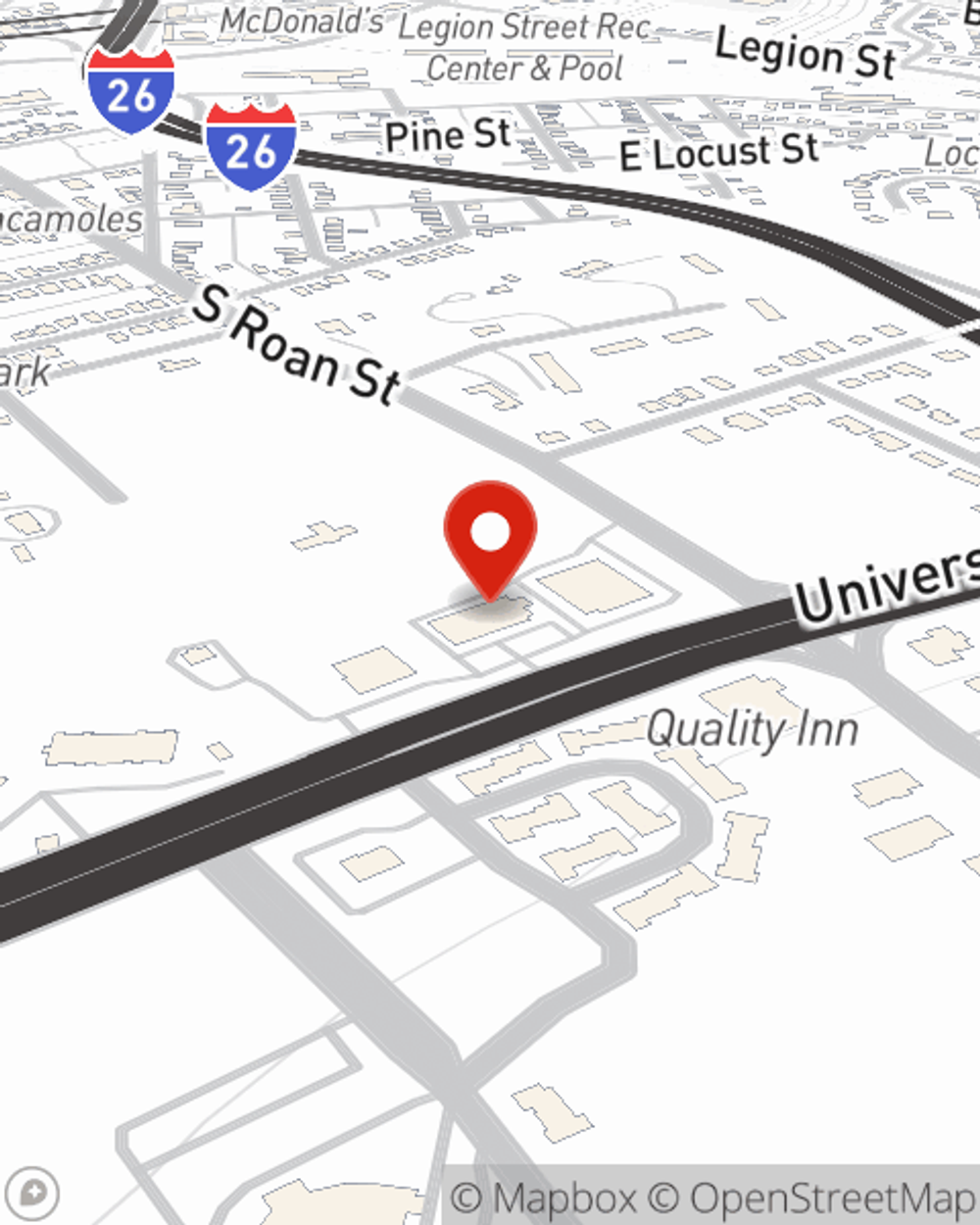

Business Insurance in and around Johnson City

Get your Johnson City business covered, right here!

Almost 100 years of helping small businesses

Business Insurance At A Great Value!

When you're a business owner, there's so much to focus on. You're not alone. State Farm agent Dennis McKesson is a business owner, too. Let Dennis McKesson help you make sure that your business is properly protected. You won't regret it!

Get your Johnson City business covered, right here!

Almost 100 years of helping small businesses

Customizable Coverage For Your Business

For your small business, whether it's a bicycle shop, a bagel shop, a barber shop, or other, State Farm has insurance options to help fit your needs! This may include coverage for things like computers, buildings you own, and business property.

At State Farm agent Dennis McKesson's office, it's our business to help insure yours. Contact our wonderful team to get started today!

Simple Insights®

Get paid what you're worth and separate personal and business finances

Get paid what you're worth and separate personal and business finances

When starting your business, you need to separate funds and answer questions like "How much should I get paid?"or "How many hours should I work?".

Rental trends: What landlords and tenants need to know

Rental trends: What landlords and tenants need to know

Understanding the current trends surrounding the rental industry will help both landlords and tenants understand how to navigate this changing landscape.

Dennis McKesson

State Farm® Insurance AgentSimple Insights®

Get paid what you're worth and separate personal and business finances

Get paid what you're worth and separate personal and business finances

When starting your business, you need to separate funds and answer questions like "How much should I get paid?"or "How many hours should I work?".

Rental trends: What landlords and tenants need to know

Rental trends: What landlords and tenants need to know

Understanding the current trends surrounding the rental industry will help both landlords and tenants understand how to navigate this changing landscape.